Daily Contribution Business Risks (Ajo, Esusu, Akawo) — And How to Avoid Them Permanently

Joseph Braide

5 minutes Read

Jan 8, 2026

5 views

Daily contribution businesses are cash-heavy, trust-based, and fragile by design.

They survive on:

- Manual records

- Human memory

- Verbal agreements

- Physical cash

That combination is dangerous at scale.

As more people join, agents grow, and money flows daily, the risks multiply. One mistake, one dishonest staff member, or one lost notebook can collapse years of trust overnight.

This article breaks down the real risks killing daily contribution businesses today—and shows exactly how smart operators eliminate them using automation with Akawo Manager.

The 7 Biggest Risks in Daily Contribution Businesses (And Their Fixes)

1. Manual Record-Keeping Errors

The Risk:

- Missing entries

- Wrong balances

- Disputes over “I paid” vs “you didn’t record it”

- Lost notebooks

Manual systems fail under pressure, especially when handling 50–500+ contributors daily.

Real Impact:

- Endless arguments

- Loss of credibility

- Members leaving silently

The Fix with Akawo Manager:

- Every transaction is recorded instantly

- Automatic balance updates

- Time-stamped records

- Zero reliance on memory

If it’s not digital, it didn’t happen.

2. Internal Fraud (Agents & Staff Theft)

The Risk:Agents collect cash daily. Temptation is real.

Common fraud patterns:

- Under-reporting collections

- Delayed remittance

- Fake entries

- “Borrowing” member funds

Why It Happens:

- No transparency

- No audit trail

- No separation of duties

The Fix with Akawo Manager:

- Agent-specific logins

- Transaction traceability (who collected what, when)

- Real-time monitoring

- Immutable transaction history

You don’t need to “trust blindly” anymore—you verify automatically.

3. Member Defaults & Payment Evasion

The Risk:Members disappear mid-cycle, especially after taking loans or withdrawing early.

Manual systems make it easy to:

- Skip days

- Argue payment history

- Exploit poor records

The Fix with Akawo Manager:

- Clear contribution history per member

- Automated loan tracking

- Outstanding balance visibility

- Proof-based dispute resolution

When members know records are transparent, defaults drop drastically.

4. No Visibility into Business Performance

The Risk:Many ajo operators can’t answer:

- How much did I collect this week?

- Who owes money?

- Which agent performs best?

- What’s my total liability today?

You’re running a financial business blindfolded.

The Fix with Akawo Manager:

- Real-time dashboards

- Daily, weekly, monthly summaries

- Agent performance reports

- Total inflow/outflow tracking

Data turns guessing into decision-making.

5. Cash Handling & Security Risks

The Risk:

- Theft during movement

- Fake robbery claims

- Losses with no evidence

Cash-heavy operations are inherently unsafe.

The Fix with Akawo Manager:

- Digital records reduce cash disputes

- Transaction proof reduces false claims

- Optional integrations for cashless workflows

Even when cash is involved, accountability protects you.

6. Scaling Breaks Manual Systems

The Risk:What works for 20 members collapses at 200.

Symptoms:

- Slower collections

- More errors

- Burnout

- Staff chaos

Most ajo businesses fail not because demand drops, but because systems can’t scale.

The Fix with Akawo Manager:

- Multi-group management

- Multi-agent access

- Centralized control

- Growth without chaos

You scale the system—not the stress.

7. Reputation & Trust Collapse

The Risk:One unresolved dispute spreads fast:

“That ajo people are not honest.”

Trust is everything—and once broken, it’s nearly impossible to rebuild.

The Fix with Akawo Manager:

- Transparent records

- Proof-backed transactions

- Professional operations

- Member confidence

Trust becomes system-based, not personality-based.

Why Automation Is No Longer Optional

Daily contribution is no longer a “small local thing.”

Today:

- People save more

- Groups are larger

- Expectations are higher

- Competition is real

Manual systems are legacy risks.

Fintech-powered operators will outlive those still using notebooks.

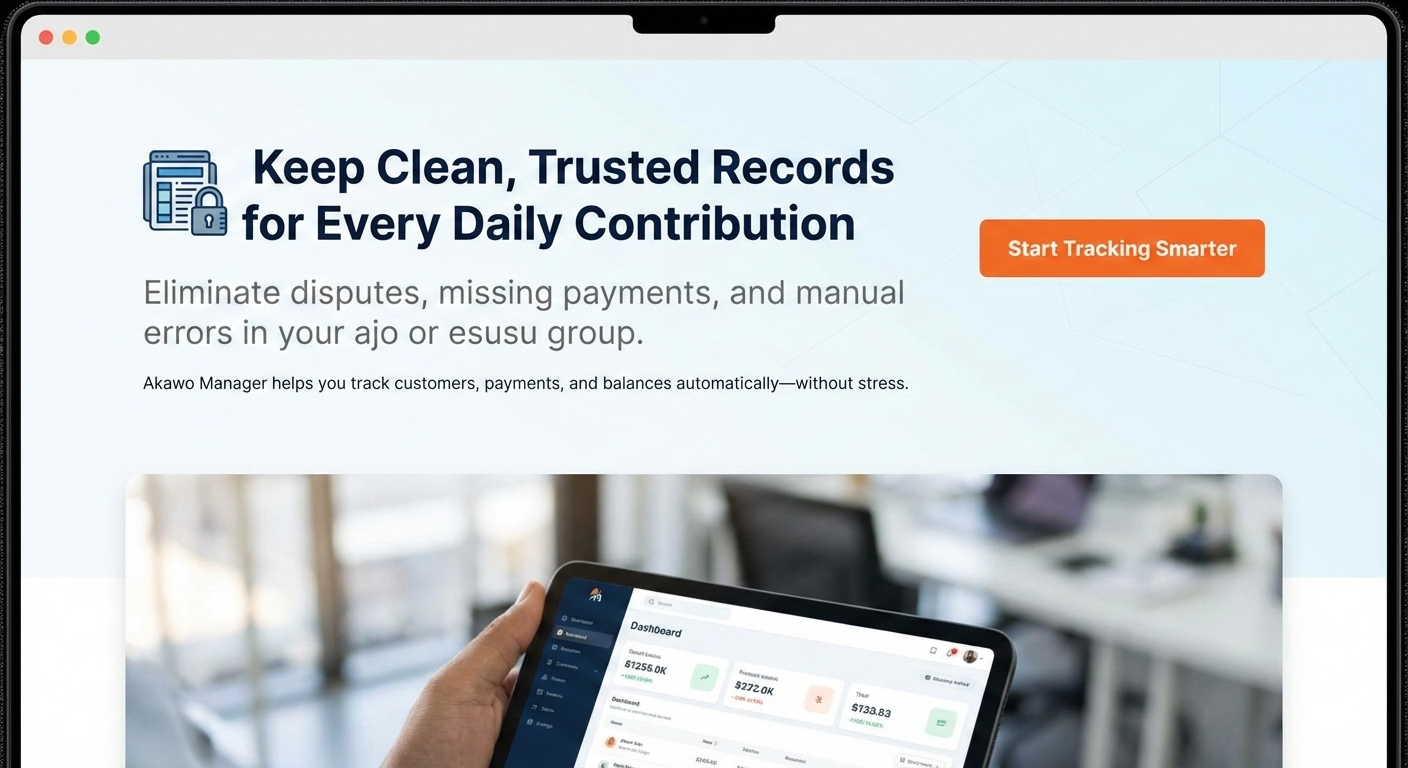

Why Akawo Manager Is Built Specifically for This Business

Akawo Manager isn’t generic accounting software.

It is designed for:

- Ajo / Esusu operators

- Daily collectors

- Contribution groups

- Informal savings structures

Core Advantages:

- Automated daily contribution tracking

- Member & agent management

- Loan & repayment visibility

- Fraud reduction through transparency

- Simple interface for non-technical users

This is purpose-built software, not adaptation.

If your daily contribution business:

- Handles real money

- Involves agents

- Has more than 10 members

Then running it manually is a calculated risk.

👉 Start managing your contribution business the smart way with Akawo Manager👉 Protect your money, reputation, and growth

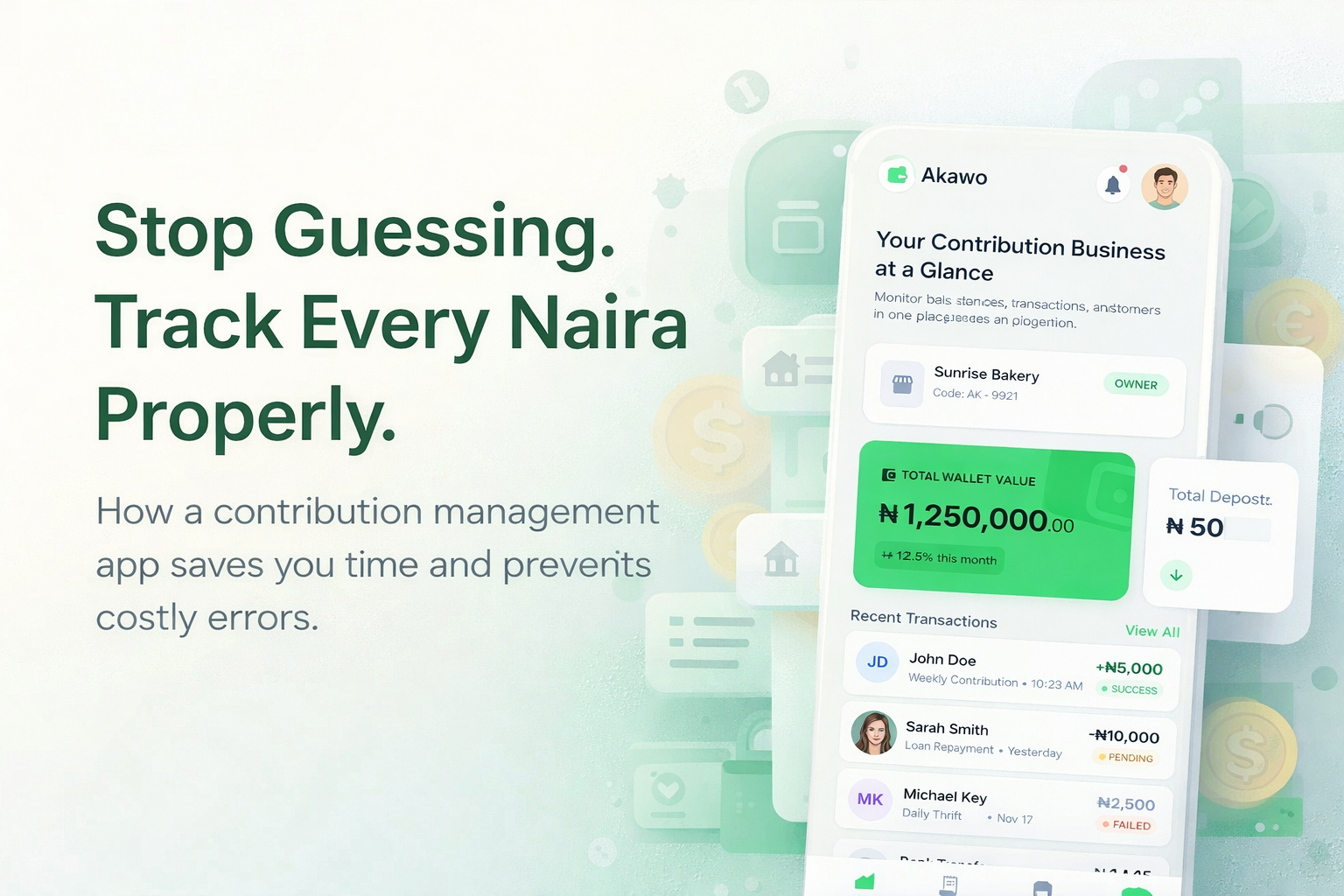

How a Contribution Management App Can Save You Time and Reduce Errors

The Hidden Cost of Manual Contribution Records If you run a daily contribution group—ajo, esusu, …

Akawo Manager vs Paper Records: Full Comparison

Still Using Paper Records for Daily Contributions? Here’s What It’s Really Costing You. For years, …

How to Keep Records for Daily Contribution Customers (Without Stress or Errors)

Managing daily contribution customers is not hard because people don’t pay — it’s hard because …