How Much Capital Do You Need to Start Ajo? (The Honest Breakdown)

Joseph Braide

5 minutes Read

Jan 9, 2026

8 views

Introduction: The Question Everyone Asks—But Gets Wrong

“How much do I need to start ajo?”

Most people expect a simple number.

But here’s the truth:

Starting an ajo business is not about how much money you have—it’s about how much risk you can control.

Many ajo businesses collapse not because they started small, but because they mismanaged records, trust, and cash flow.

This guide gives you the real capital breakdown, common mistakes, and how smart operators start lean, safe, and scalable using tools like Akawo Manager.

Short Answer: You Can Start Ajo With ₦0—But That’s Dangerous

Yes, technically, some ajo collectors start with zero personal capital by:

- Collecting daily contributions

- Holding funds temporarily

- Paying members at the end of cycles

But this model relies entirely on:

- Perfect record-keeping

- Zero defaults

- Absolute trust

In reality, one error or dispute can ruin you.

Let’s break this down properly.

The 3 Capital Models for Starting Ajo

1. Zero-Capital Model (High Risk)

How it works:

- Members contribute daily

- You hold the money

- Payout happens later

Hidden risks:

- No buffer for mistakes

- One lost record = unpaid member

- No protection against fraud or disputes

Who this works for:

- Very small groups (5–10 people)

- Short cycles

- High personal trust

Reality:

This model collapses quickly without automation.

2. Low-Capital Model (₦50,000 – ₦300,000) ✅ Recommended

This is where serious operators start.

What the capital covers:

- Temporary shortfalls

- Early withdrawals

- Emergency payouts

- Small operational costs

Why this works:

- You’re not panicking when issues arise

- Members trust you more

- You operate professionally

With Akawo Manager, this model becomes extremely powerful because:

- Records are accurate

- Defaults are tracked

- Cash flow is visible daily

3. Growth-Ready Model (₦500,000 – ₦2M+)

This is for operators who want to:

- Run multiple groups

- Offer loans

- Scale fast

- Employ agents

At this level:

- Manual records fail

- Fraud risk increases

- Complexity multiplies

Automation is no longer optional.

The Real Capital Most People Ignore: Operational Capital

Most ajo guides talk only about cash. That’s a mistake.

Hidden Capital You Must Plan For:

- Record-keeping system (manual = risk)

- Agent accountability

- Dispute resolution

- Loan tracking

- Growth management

These are operational risks, not just financial ones.

A ₦100k ajo business with automation is safer than a ₦1M ajo business with notebooks.

Common Mistakes That Kill New Ajo Businesses

1. Starting With Cash But No System

Money without structure attracts chaos.

2. Trusting Memory or Paper

Memory fades. Paper gets lost. Disputes don’t.

3. Scaling Too Early

More members ≠ more profit if systems break.

4. No Visibility

If you can’t answer “Who owes what?” instantly—you’re exposed.

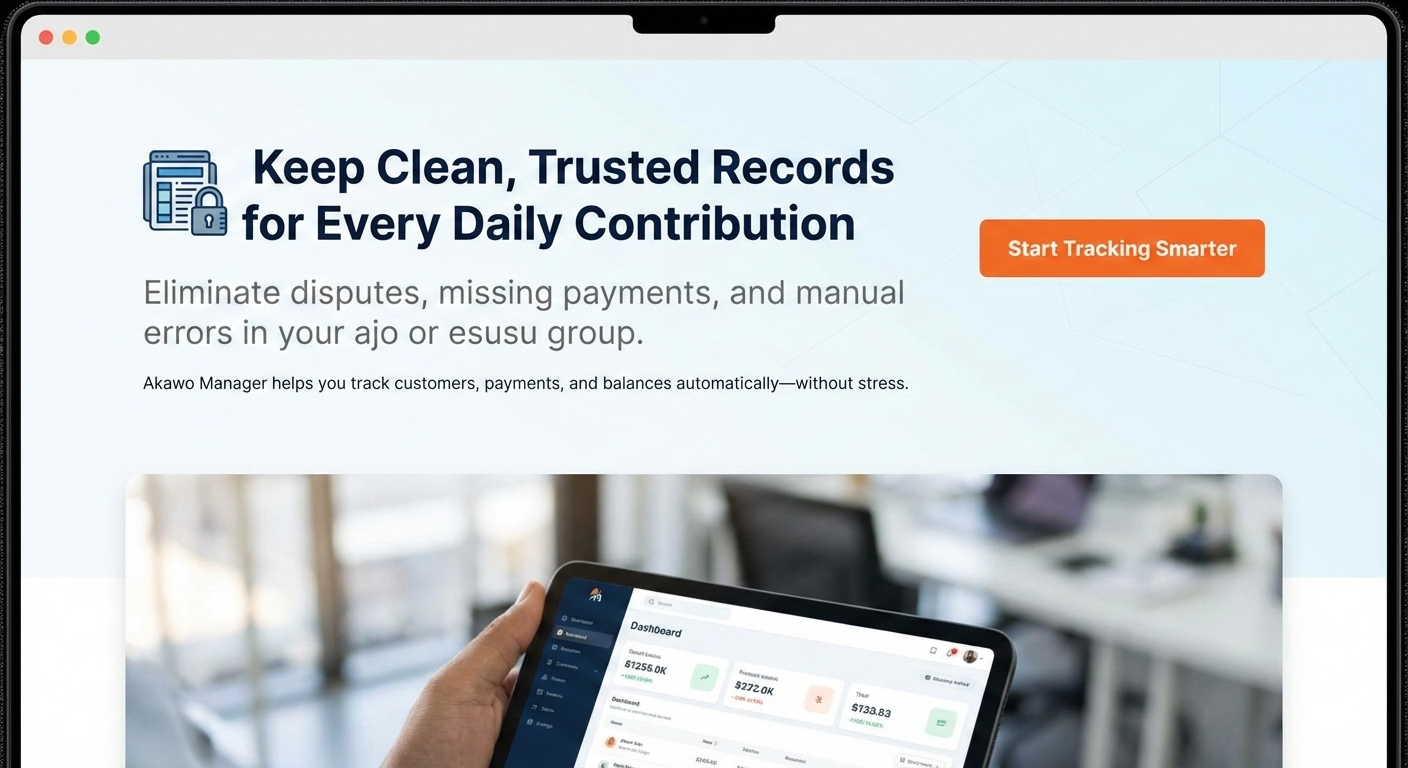

How Akawo Manager Reduces the Capital You Need

This is where most people get it wrong.

Automation reduces risk—and risk reduces required capital.

With Akawo Manager:

- Every contribution is recorded instantly

- Member balances update automatically

- Agent collections are traceable

- Defaults and loans are visible

- Reports show daily inflow/outflow

That means:

- Fewer disputes

- Less emergency cash needed

- More confidence from members

- Easier scaling

You’re not padding capital to cover mistakes—you’re eliminating mistakes.

A Practical Example

Scenario:

- 30 members

- ₦1,000 daily contribution

- 30-day cycle

Total cycle value: ₦900,000

Without automation:

- One error = ₦30k–₦50k loss

- Disputes cost reputation

- Capital buffer must be high

With Akawo Manager:

- Zero confusion

- Clear audit trail

- Lower buffer needed

- Higher trust → more members

So, How Much Capital Do You Need?

Here’s the honest answer:

| Your Goal | Recommended Capital |

|---|---|

| Test with small group | ₦0 – ₦50k |

| Run professionally | ₦100k – ₦300k |

| Scale & offer loans | ₦500k+ |

| Minimize risk | Automation (non-negotiable) |

Final Truth: Systems Matter More Than Capital

Many people are waiting to “get enough money” before starting ajo.

That’s backwards.

Start with the right system, then grow the money.

Akawo Manager gives you:

- Control

- Transparency

- Professionalism

- Peace of mind

If you’re serious about starting or growing an ajo business:

👉 Don’t just raise capital—build a system

👉 Start using Akawo Manager to run ajo the smart way

Your future self (and your members) will thank you.

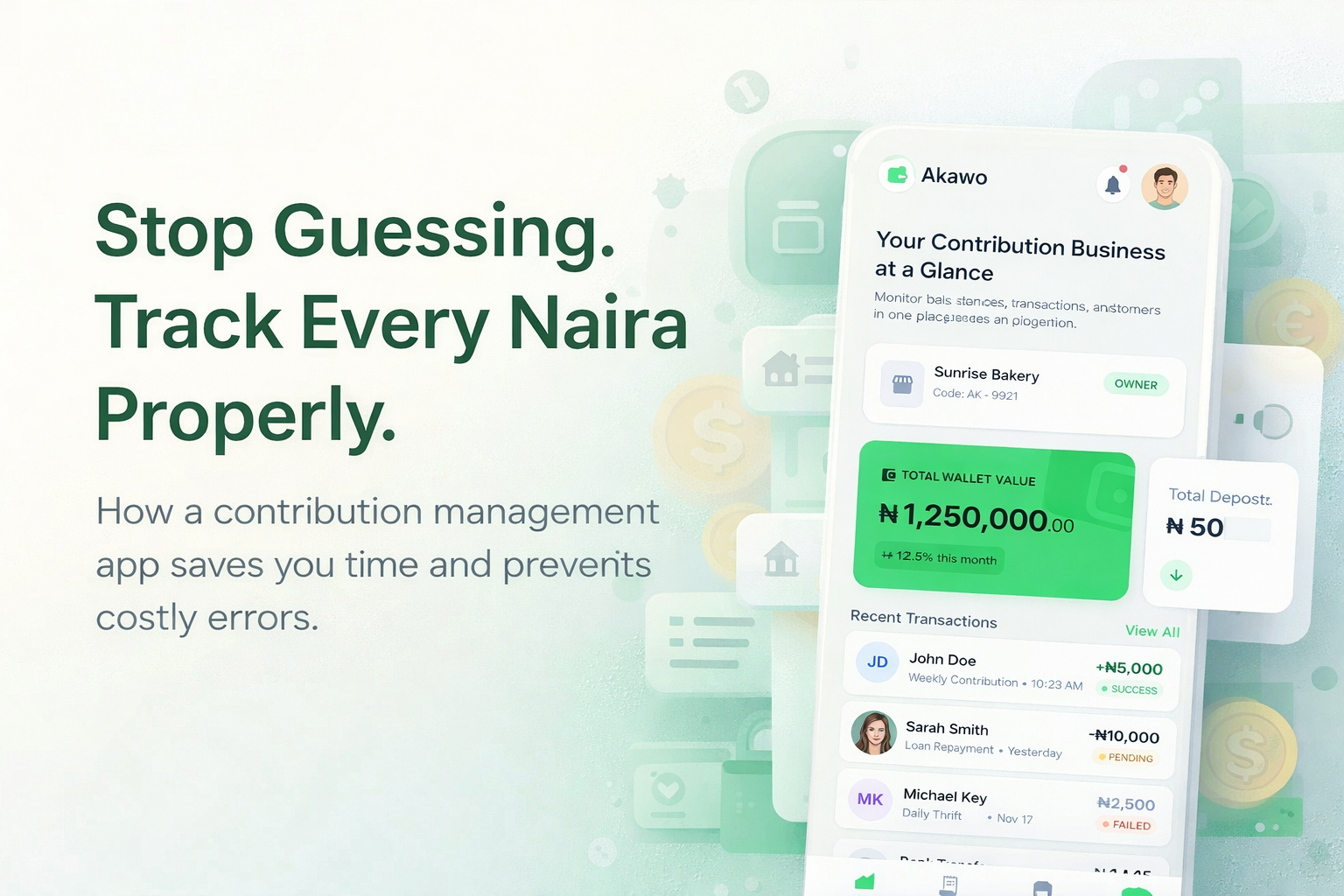

How a Contribution Management App Can Save You Time and Reduce Errors

The Hidden Cost of Manual Contribution Records If you run a daily contribution group—ajo, esusu, …

Akawo Manager vs Paper Records: Full Comparison

Still Using Paper Records for Daily Contributions? Here’s What It’s Really Costing You. For years, …

How to Keep Records for Daily Contribution Customers (Without Stress or Errors)

Managing daily contribution customers is not hard because people don’t pay — it’s hard because …