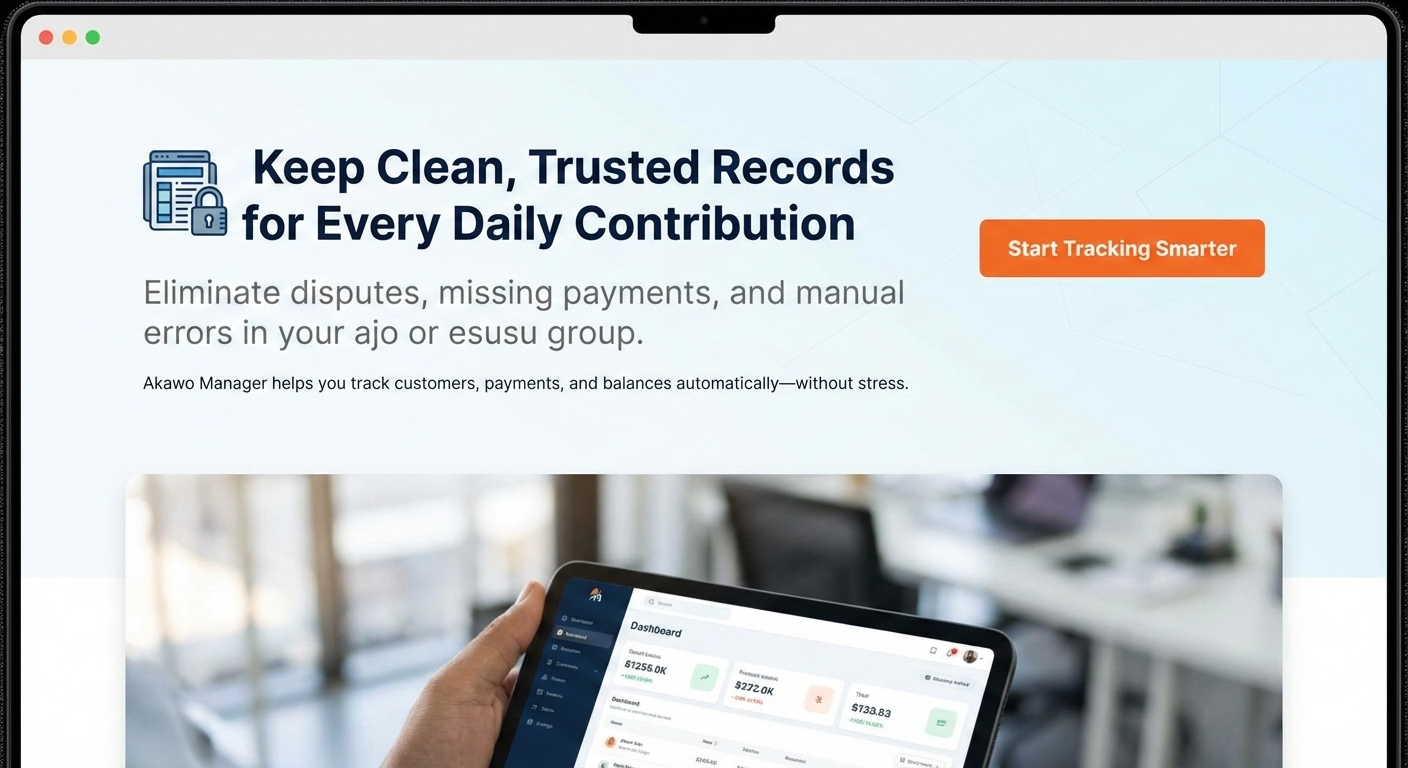

How to Keep Records for Daily Contribution Customers (Without Stress or Errors)

Joseph Braide

5 minutes Read

Jan 3, 2026

14 views

Managing daily contribution customers is not hard because people don’t pay —

it’s hard because records are scattered, manual, and unreliable.

If you run an ajo, esusu, or daily savings group, chances are you’ve experienced at least one of these:

- Missing payment records

- Customers disputing balances

- Staff “forgetting” collections

- Money collected but not accounted for

- End-of-month confusion and arguments

The truth is simple:

If your records are weak, your business is leaking money.

This guide shows you how to properly keep records for daily contribution customers, the right way, and how modern group owners are using tools like Akawo Manager to eliminate stress, fraud, and guesswork.

Why Proper Record-Keeping Is the Backbone of Daily Contributions

Daily contribution businesses run on trust.

Once trust is broken, customers leave — and they tell others.

Poor record-keeping leads to:

- ❌ Disputes over payments

- ❌ Accusations of fraud

- ❌ Staff manipulation

- ❌ Inability to scale

- ❌ Burnout for the group owner

Yet many operators still rely on:

- Paper notebooks

- WhatsApp chats

- Memory

- Excel files updated “later”

These systems fail as soon as:

- You add more customers

- You hire agents

- You manage multiple groups

The 5 Core Records Every Daily Contribution Business Must Keep

To run a clean and scalable operation, you must track five non-negotiable records.

1. Customer Profile Records

Every contributor must have:

- Full name

- Phone number

- Contribution plan

- Start date

- Assigned agent (if any)

Problem:

Paper books mix customers together → easy to confuse names and payments.

Akawo Manager Solution:

Each customer gets a digital profile — no duplicates, no confusion.

2. Daily Payment Records

This is the heart of the business.

For every payment, you must record:

- Amount paid

- Date & time

- Who recorded it

- Payment status

Common mistake:

“Marking later” or bulk updating at night.

That’s how money disappears.

Akawo Manager Advantage:

- Payments are recorded in real time

- Timestamped automatically

- No editing history can be hidden

3. Contribution Balance Tracking

Customers constantly ask:

“How much have I paid so far?”

If you calculate manually, errors are inevitable.

With Akawo Manager:

- Balances update automatically

- Total paid, remaining balance, and withdrawals are always visible

- Customers trust what they can see

4. Withdrawal & Payout Records

Withdrawals cause the most disputes.

You must clearly track:

- Withdrawal amount

- Date

- Remaining balance after payout

Manual systems fail here.

Akawo Manager ensures:

- Withdrawals are logged instantly

- Balances adjust automatically

- No room for manipulation

5. Agent / Staff Activity Records

If you use collectors or agents, this is critical.

You must know:

- Who collected from whom

- How much was collected

- When it was recorded

Without this, fraud thrives.

Akawo Manager gives you:

- Agent-level accountability

- Full audit trails

- Transparency across the business

Step-by-Step: How to Keep Daily Contribution Records the Smart Way

✅ Step 1: Stop Using Paper as Your Primary System

Paper can be a backup — not your source of truth.

It cannot:

- Scale

- Protect against fraud

- Resolve disputes

✅ Step 2: Centralize All Records in One System

Your business needs:

- One dashboard

- One source of truth

- Real-time updates

Akawo Manager centralizes:

- Customers

- Payments

- Withdrawals

- Agents

- Reports

✅ Step 3: Record Payments Immediately

Delayed entries = missing money.

With Akawo Manager:

- Payments are recorded on the spot

- Even agents can record safely

- You see everything live

✅ Step 4: Use Automated Summaries

At any time, you should see:

- Total collected today

- Total per customer

- Total per agent

No calculations.

No end-of-day stress.

✅ Step 5: Give Customers Transparency

Trust grows when customers can:

- Ask about balances confidently

- Receive clear explanations

- See consistent records

This is how daily contribution businesses grow by referral.

Manual Records vs Digital Records (Quick Comparison)

Why Successful Contribution Groups Are Going Digital

Across Nigeria and Africa:

- Fintech adoption is rising

- Customers expect transparency

- Regulators are paying attention

Group owners who fail to adapt will struggle.

Those who adopt tools like Akawo Manager:

- Spend less time arguing

- Lose less money

- Scale faster

- Sleep better

Final Thoughts: Records = Revenue Protection

If you want your daily contribution business to:

- Grow

- Last

- Attract serious customers

Then record-keeping is not optional.

It’s your strongest defense against:

- Fraud

- Errors

- Burnout

🚀 Ready to Keep Clean, Trusted Records?

Akawo Manager helps you:

- Track customers

- Record daily payments

- Prevent fraud

- Manage agents

- Scale with confidence

👉 Start using Akawo Manager today and take control of your contribution records.

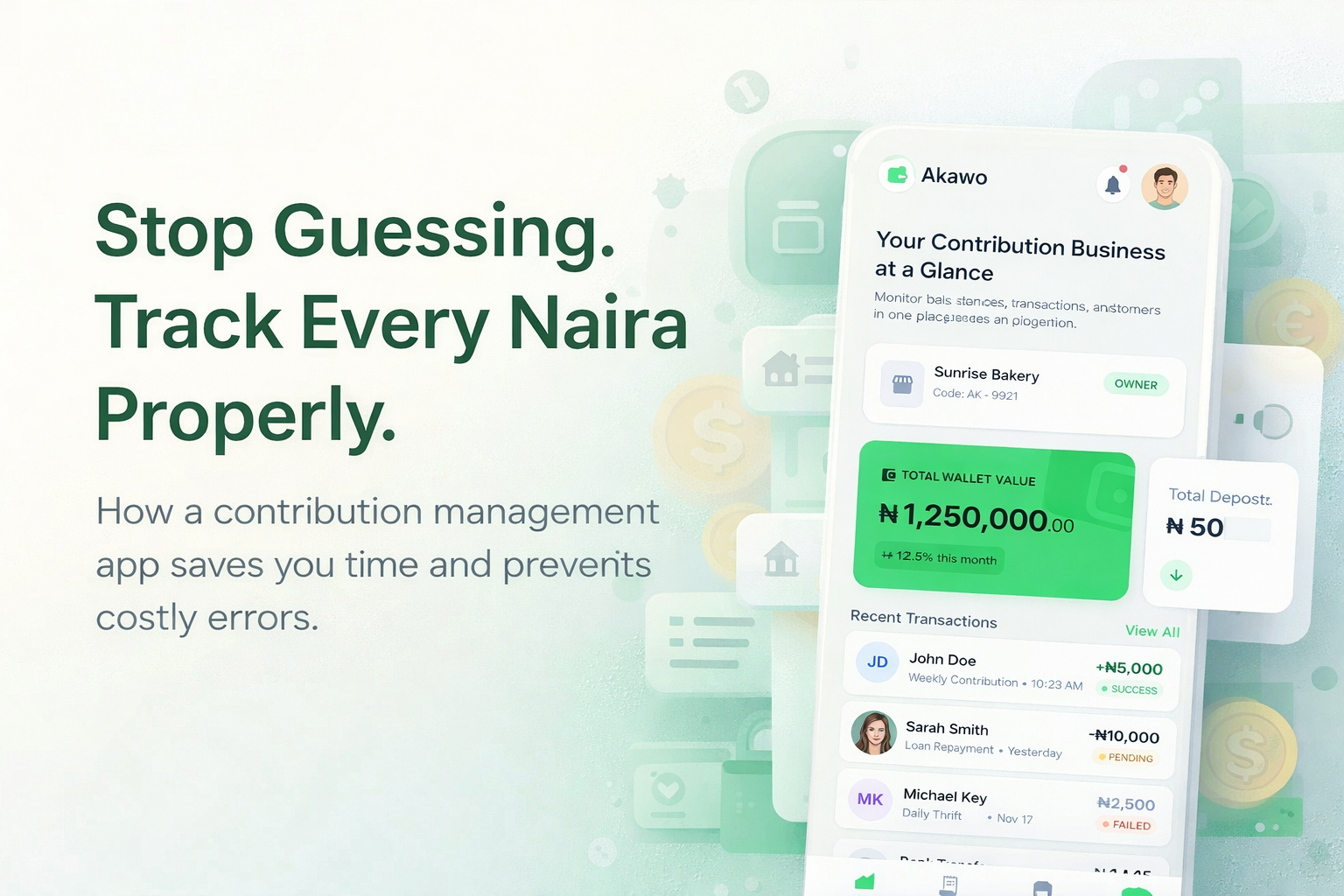

How a Contribution Management App Can Save You Time and Reduce Errors

The Hidden Cost of Manual Contribution Records If you run a daily contribution group—ajo, esusu, …

Akawo Manager vs Paper Records: Full Comparison

Still Using Paper Records for Daily Contributions? Here’s What It’s Really Costing You. For years, …

How to Keep Records for Daily Contribution Customers (Without Stress or Errors)

Managing daily contribution customers is not hard because people don’t pay — it’s hard because …